My Wake-Up Moment with GRI Reporting

Back in 2023, I was consulting for a fast-growing food processing company in Nashik. They were eco-conscious, treated workers well, and had solid governance practices. But when we sat down to create their ESG report, the room went silent.

- “How do we measure our social impact?”

- “What’s the benchmark for water usage efficiency?”

- “What even is GRI?”

We realized something humbling: having values is not enough—communicating them transparently is where most Indian businesses fail.

That led me to the Global Reporting Initiative (GRI)—a gold standard for sustainability reporting used in over 100 countries. Fast forward to today, every ESG strategy we deploy at Prgenix starts with one core question:

“How does this align with GRI?”

And for good reason. According to GRI’s 2024 disclosure report, over 78% of the top 250 global companies now use GRI standards. In India, it’s fast becoming the backbone of credible ESG compliance.

Why the GRI Framework Matters in ESG Compliance?

Let’s break it down: ESG is the what, but GRI is the how.

✅ 1. Global Credibility

GRI is the most widely used ESG reporting framework globally. If you’re aiming to win international investors, clients, or partnerships, using GRI instantly signals maturity and transparency.

✅ 2. Sector-Neutral + Sector-Specific

Unlike some frameworks that are rigid or industry-bound, GRI offers universal standards (like GRI 2: General Disclosures) and sector-specific standards—from mining to media.

✅ 3. Aligns with Indian Mandates

While SEBI mandates BRSR for top 1000 companies, GRI seamlessly maps into the BRSR structure. That means one report can serve multiple compliance needs.

Step-by-Step GRI Framework Implementation (Simplified for Indian Businesses)

Here’s the exact roadmap we use at Prgenix to embed the GRI Framework:

🔍 Step 1: Identify Material Topics

Your ESG report should focus on what matters. Use stakeholder interviews, internal risk registers, and peer benchmarking to shortlist 10–15 relevant material topics.

💡 Common Indian business topics:

- Waste management

- Water usage

- Diversity & inclusion

- Supply chain ethics

- Board diversity

➡ Reference: GRI Materiality Guidelines

📊 Step 2: Map to GRI Standards

Let’s say “energy consumption” is material. Here’s how you map it:

- Use GRI 302: Energy

- Disclose: Total energy consumed, sources, reductions achieved

- Methodology: Specify units, assumptions, tools

⚠️ Tip: Be transparent about data boundaries and limitations. GRI rewards transparency more than perfection.

🧩 Step 3: Align Governance Structures

You must include disclosures from GRI 2 (General Disclosures):

- Ethics & integrity

- Governance roles

- Strategy & risk management

- Remuneration policies

- Stakeholder engagement

These create a “backbone” for your ESG report and improve alignment with BRSR/SEBI guidelines.

📤 Step 4: Design & Publish the Report

Structure it this way:

- CEO Message (vision, tone)

- GRI Content Index (must include standard numbers)

- Sectioned topics with KPIs, targets, and actuals

- Methodology & data limitations

- External assurance statement (if applicable)

Make it:

- Machine-readable (HTML)

- Shareable (PDF)

- Accessible (WCAG-compliant)

🎯 Bonus Tip: Translate your executive summary into Hindi if you’re engaging domestic stakeholders.

Advanced Tips for Maximizing GRI Impact

🔐 1. Go for Third-Party Assurance

Firms with assured reports see 42% more investor engagement. In India, BSI, DNV, and TUV SUD offer excellent ESG audit services.

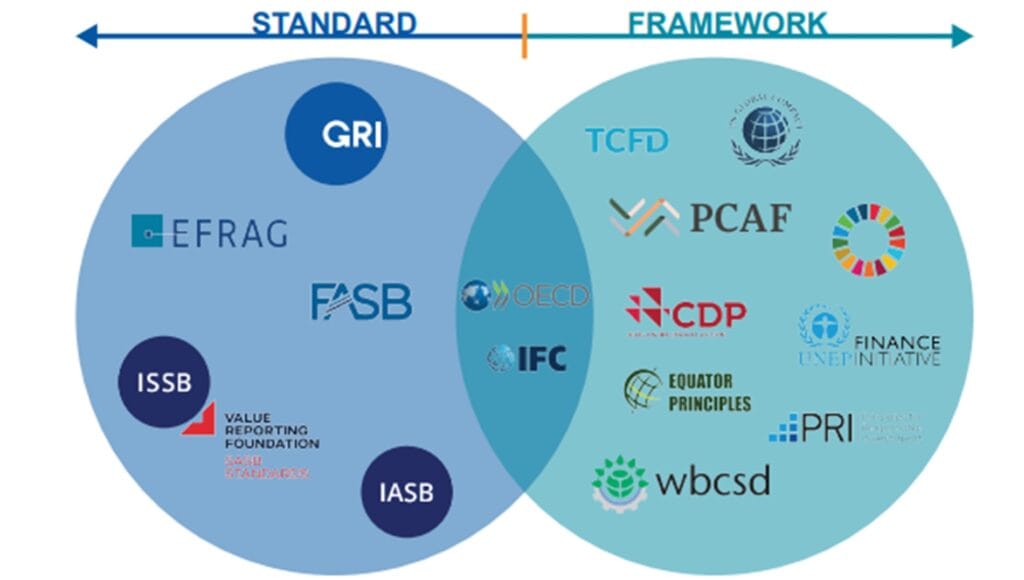

🔄 2. Integrate with Other Frameworks

Want to impress both SEBI and European clients? Use GRI as your base, and add overlays:

- SASB for sector financials

- TCFD for climate risks

- BRSR for Indian compliance

🧠 3. Automate with AI Tools

We’ve deployed NLP-based tagging bots that auto-map internal reports to GRI indicators. Saves 60+ hours per quarter. Ask me how.

Case Study: From Manual to GRI-Compliant in 90 Days

We worked with a tier-1 supplier in India’s auto sector in mid-2023. They had never published a sustainability report.

Here’s what we did:

- Ran a GRI-aligned materiality assessment across 6 locations

- Mapped 14 key topics to GRI 2, 302, 403, and 405

- Built automated Excel dashboards for quarterly tracking

- Outsourced assurance to TUV Nord

📈 Outcome?

Within 3 months:

- Report published

- Featured on Tata Motors’ preferred vendor list

- Won ₹8.6 Cr worth of new contracts in 2024

That’s the GRI multiplier in action.

FAQs: People Also Ask

1. What is the GRI Framework in ESG reporting?

The GRI Framework is a set of standards developed by the Global Reporting Initiative to guide businesses in disclosing their environmental, social, and governance (ESG) performance in a structured, credible way.

2. Is GRI mandatory for Indian companies?

No, but it aligns strongly with India’s SEBI BRSR mandate. Many top Indian firms use GRI to meet both domestic and global expectations.

3. How does GRI compare to SASB and TCFD?

GRI is broader and impact-focused. SASB is more financial-risk oriented. TCFD focuses on climate risk. You can combine them for a complete picture.

4. How long does it take to implement GRI?

For first-time adopters, it usually takes 60–120 days depending on data maturity and team readiness.

5. Can MSMEs in India use GRI?

Absolutely. GRI is scalable and has specific guidance for SMEs and non-listed companies.

GET YOUR FREE ESG ROADMAP TODAY

Need a GRI-Aligned ESG Report That Attracts Investors?

Let our compliance strategists at Prgenix help you decode, draft, and publish a fully GRI-compliant ESG report in just 60 days.