From Ignorance to Impact—My ESG Wake-Up Call

Back in early 2022, I sat across from a visibly agitated investor during a pitch. He wasn’t interested in my projected ROI or my pitch deck visuals. Instead, he hit me with a question I didn’t expect:

“What are your Scope 3 emissions, and how do they compare year-over-year?”

I froze. I’d heard of ESG—Environmental, Social, Governance—but I hadn’t treated it seriously. Fast-forward to 2025, and that moment turned out to be a business-saving wake-up call.

Today, ESG isn’t a buzzword. It’s a baseline.

According to MSCI, over 87% of global investors now integrate ESG metrics into their portfolio decisions, and India’s SEBI-mandated BRSR disclosures have made ESG reporting a legal requirement for the top 1,000 listed companies.

So, here’s the brutal truth: If you’re not tracking the right ESG metrics in 2025, you’re not just missing opportunities—you’re actively risking reputation, investor confidence, and regulatory fines.

In this post, I’ll walk you through the Top 10 ESG Metrics for 2025 that matter the most—plus how we applied them at Prgenix, and the surprising results.

Why ESG Metrics Matter in 2025?

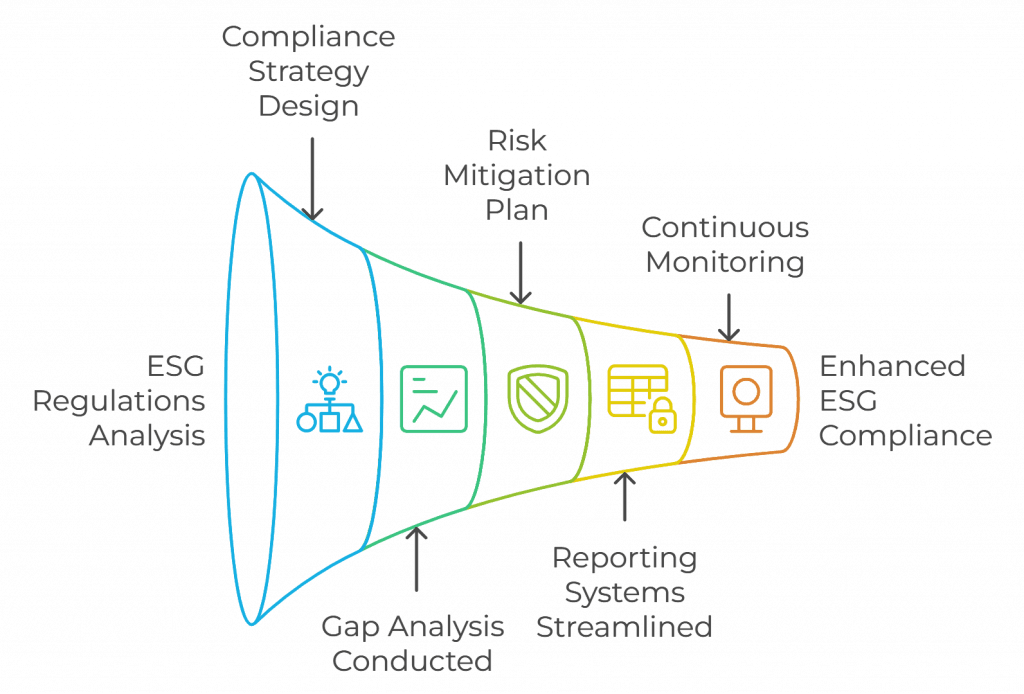

1. Regulatory Pressure is Real

India’s regulatory framework is tightening fast. SEBI’s BRSR Core mandates ESG disclosures with assurance requirements, and many global firms now require Indian suppliers to show ESG alignment.

2. Investors Are Prioritizing Transparency

Private equity firms, ESG-focused VC funds, and institutional investors are demanding metric-driven disclosures. Fluff won’t cut it anymore.

3. Customers Are Voting With Their Wallets

In a 2024 Nielsen study, 73% of Gen Z buyers in India said they prefer brands that align with sustainability goals. ESG is no longer an internal KPI—it’s a public differentiator.

The Top 10 ESG Metrics You Must Track in 2025

Let’s break them down across the E, S, and G dimensions with examples and practical use.

1. Carbon Emissions – Scope 1, 2, and 3

Why it matters: Scope 3 (supply chain) emissions now account for over 70% of a typical firm’s carbon footprint.

How to track: Use GHG Protocol tools or tie into BRSR Core’s greenhouse gas metrics.

Pro Tip: Track intensity (e.g., CO2/₹ revenue) instead of absolute values for comparability.

2. Water Usage and Wastewater Management

Why it matters: India is facing a national water crisis. ESG reporting frameworks like GRI require disclosure on water withdrawal and recycling.

Tracking Tips: Implement IoT-based water metering. Report percentage of water reused.

3. Energy Consumption from Renewable Sources

Why it matters: Renewable energy use directly aligns with SDG 7 and reduces Scope 2 emissions.

KPI to Watch: % of total energy sourced from solar, wind, or hydropower.

4. Employee Turnover Rate (Voluntary)

Why it matters: High turnover signals poor work culture or leadership.

What to Report: Breakdown by gender, age, and department—especially for BRSR compliance.

5. Workplace Diversity Ratio

Why it matters: Diversity is now a boardroom metric, not just an HR initiative.

Key Metric: % of women, differently abled, and minorities in leadership roles.

6. Injury Rate / Lost-Time Incident Frequency

Why it matters: Especially critical in manufacturing, pharma, and logistics sectors.

Pro Tip: Normalize per 1,000 hours worked.

7. Board Independence and Diversity

Why it matters: Governance is the least understood but most impactful ESG domain.

KPI to Watch: % of independent directors + representation by gender and industry expertise.

8. Data Privacy Breach Incidents

Why it matters: With the DPDP Act 2023–25 now in force, data security is a governance issue.

What to Track: Number and severity of breaches, response time, and user notification metrics.

9. CSR Spend as % of Net Profit

Why it matters: In India, CSR is legally mandated under the Companies Act. ESG frameworks demand proof of impact, not just expense.

Pro Tip: Align your CSR KPIs with SDGs for storytelling in annual reports.

10. Whistleblower Complaints and Resolution Time

Why it matters: A strong speak-up culture signals ethical governance.

Track This: Complaints per 100 employees + median resolution time.

How We Implemented These Metrics at Prgenix?

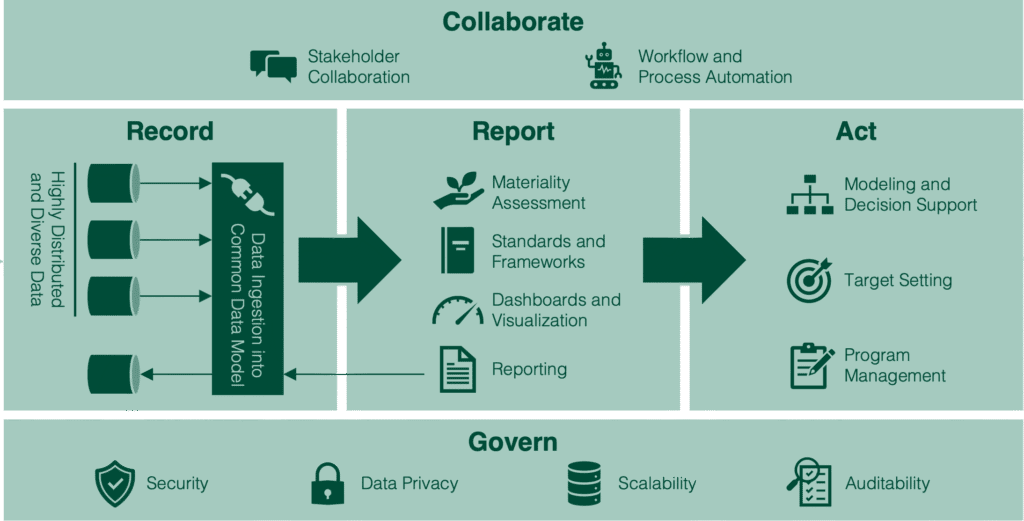

Context: In 2023, Prgenix committed to going ESG-compliant as part of our consultancy pivot. We created a custom ESG dashboard integrated with our internal BI tools.

The Plan:

- Mapped metrics to international frameworks (GRI, SASB, BRSR).

- Collected baseline data from HR, Ops, Legal, and CSR.

- Set quarterly benchmarks with automated alerts.

- Published our first ESG micro-report in Jan 2024.

Result:

✅ 27% reduction in energy consumption

✅ 18% employee turnover drop

✅ 2 major client wins citing ESG as a differentiator

Advanced Tips: Most ESG Reports Miss

- Monetize your metrics: Show financial outcomes linked to ESG moves.

- Visualize everything: Dashboards > PDFs.

- Third-party assurance: Hire an ESG auditor to validate your data.

- Double materiality: Evaluate impact on and by your company (EU-style).

FAQs – People Also Ask

1. What is the most important ESG metric in 2025?

Carbon emissions (especially Scope 3) due to regulatory pressure and climate risk disclosures.

2. Are ESG metrics mandatory in India?

Yes, for top 1,000 listed companies via SEBI’s BRSR Core. For others, voluntary but increasingly demanded by stakeholders.

3. How do I start ESG reporting for my business?

Start with a materiality assessment. Then identify top 10 metrics, baseline them, and create a roadmap using BRSR or GRI standards.

4. What are Scope 1, 2, and 3 emissions?

- Scope 1: Direct emissions from owned sources

- Scope 2: Indirect emissions from purchased energy

- Scope 3: All other indirect emissions (supply chain, travel, etc.)

5. Can small businesses track ESG metrics?

Absolutely. Even a simple Excel sheet can kick off your ESG journey. Focus on relevant metrics and scale up.

Final Thoughts: It’s Time to Lead, Not Follow

If you’re reading this in mid-2025 and still waiting for “the right time” to start ESG reporting, I’ve got bad news: you’re already behind.

But the good news? It’s not too late to lead.

Start with these 10 metrics. Be transparent. Get external assurance. And use ESG not just to tick boxes—but to build a business your customers, investors, and team will trust.

MAKE ESG YOUR COMPETITIVE ADVANTAGE