How to File BRSR Report? A Practical, Step-by-Step Guide for Indian Companies (BRSR 2.0 Ready)

If you’re responsible for compliance, sustainability, or investor reporting in an Indian company, chances are this question has already landed on your desk—How to file BRSR report?

And not in a theoretical sense. You’re probably staring at the format, the KPIs, the ESG data gaps, and wondering how all of this is supposed to come together without turning into a last-minute scramble.

You’re not alone.

BRSR filing looks deceptively simple on paper. In reality, it forces organizations to confront how well they actually understand their environmental, social, and governance performance. This article breaks the process down the way it happens in the real world—step by step, with context, logic, and practical clarity. By the end, you’ll know exactly how to file a BRSR report, what data you need, where companies usually go wrong, and how to stay aligned with BRSR 2.0 expectations.

What Exactly is BRSR and Why Filing It is No Longer Optional?

Before we get into how to file BRSR report, let’s ground ourselves in the “why.”

The Business Responsibility and Sustainability Report (BRSR) is mandated by Securities and Exchange Board of India for the top 1000 listed companies by market capitalization. It replaces the older BRR framework and shifts the focus from policy statements to measurable ESG performance.

Here’s the key shift many companies miss:

- BRSR is not a sustainability brochure. It is a disclosure-based, data-driven regulatory filing that investors, lenders, and regulators actually scrutinize.

With BRSR 2.0, this scrutiny becomes sharper. Expect higher expectations around data consistency, traceability, and alignment with global ESG norms.

Who Needs to File BRSR Report—and From Which Financial Year?

As of now, BRSR filing applies to:

- Top 1000 listed companies (by market cap)

- Mandatory from FY 2022–23 onwards

- Submitted as part of the Annual Report

Unlisted companies, subsidiaries, and private firms are not mandated yet—but here’s the thing. Many of them are already being asked for BRSR-aligned data by investors, banks, and large customers.

So even if you’re not mandated today, learning how to file BRSR 2.0 report prepares you for what’s coming next.

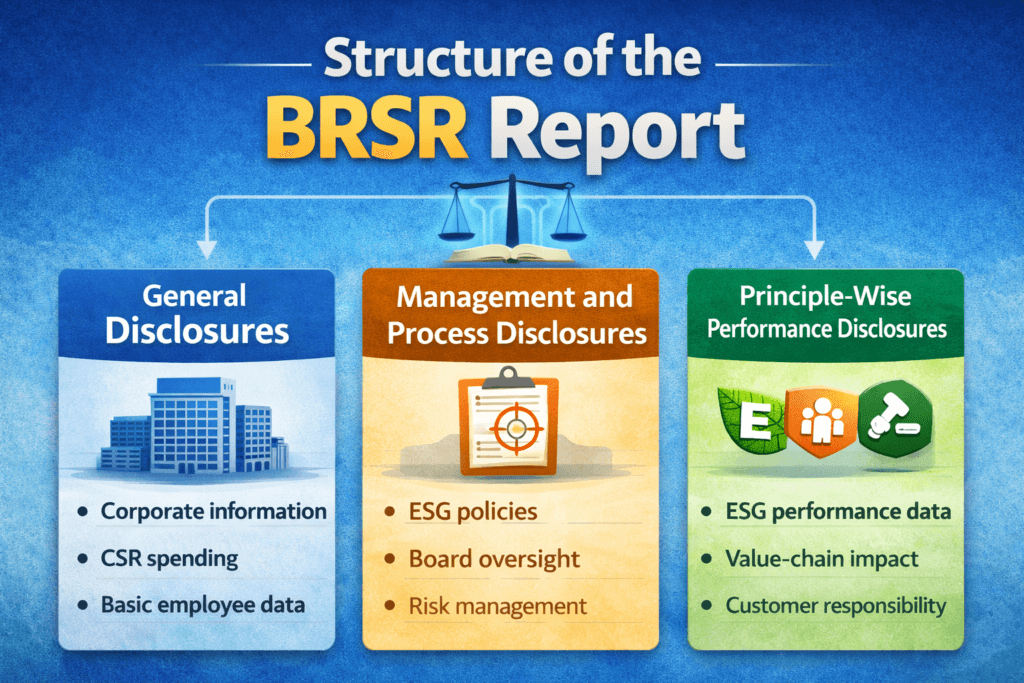

Understanding the Structure of the BRSR Report (Before You Start Filing)

This is where most teams stumble. They jump into data collection without understanding the architecture of the report.

The BRSR format is divided into three major sections:

1. General Disclosures

This covers basic corporate information:

- CIN, sector, products, locations

- Employee count, turnover, subsidiaries

- CSR applicability and spending

Straightforward? Mostly. But even here, inconsistencies between annual reports and BRSR disclosures can trigger red flags.

2. Management and Process Disclosures

This section examines intent and governance:

- ESG policies and approvals

- Board and committee oversight

- Risk management processes

- Stakeholder grievance mechanisms

This is where your documentation maturity gets tested. Policies without board approval or outdated SOPs often surface here.

3. Principle-Wise Performance Disclosures

This is the core of BRSR reporting.

Nine principles. Hundreds of data points. Quantitative and qualitative disclosures across environment, labor, human rights, ethics, and customer responsibility.

If you’re asking how to file BRSR report without chaos, the answer lies in mastering this section early.

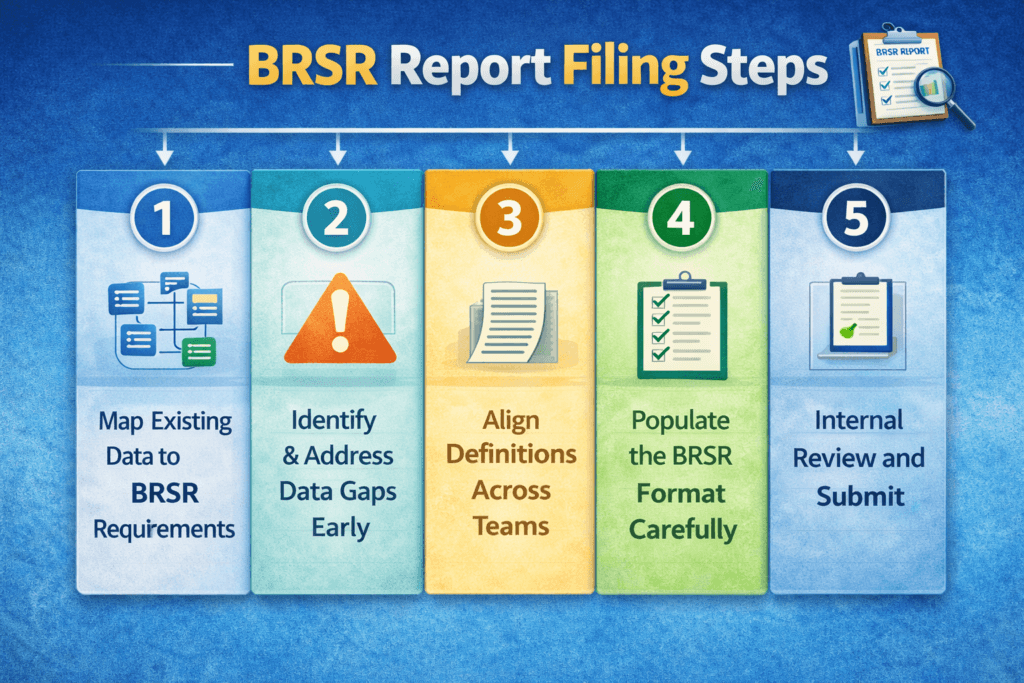

How to File BRSR Report the Right Way?

Let’s break this down practically.

Step 1: Map BRSR Requirements Against Existing Data

Before collecting new data, ask a hard question: What do we already have?

Most companies already generate ESG-relevant data across departments:

- HR (diversity, training hours, attrition)

- EHS (energy, water, waste, emissions)

- Legal & Compliance (codes, whistleblower cases)

- Procurement (vendor screening, audits)

Create a BRSR data mapping sheet that links each disclosure to a data owner. This alone eliminates weeks of confusion.

Step 2: Identify Data Gaps Early (This Saves Time Later)

Here’s the uncomfortable part.

BRSR forces disclosures on areas companies haven’t historically tracked, such as:

- Scope-wise energy consumption

- Gender pay metrics

- Value-chain ESG assessments

- Occupational health incident rates

- ESG-linked KPIs reviewed by the board

Don’t wait till the end to discover these gaps. Flag them upfront and decide:

- Can data be estimated responsibly?

- Does it require process changes?

- Should you disclose “not available” with justification?

Regulators don’t expect perfection—but they do expect transparency.

Step 3: Align Internal Definitions Across Teams

This sounds trivial. It isn’t.

If HR defines “employee” differently from Finance, and EHS reports site-level data while Corporate reports consolidated numbers, your BRSR filing will look inconsistent.

One of the most common BRSR report filing errors is definition mismatch.

Fix this by:

- Standardizing definitions

- Freezing reporting boundaries

- Documenting assumptions clearly

Step 4: Populate the BRSR Format—Carefully

Now comes the actual filing work.

Populate the BRSR format exactly as prescribed. Avoid marketing language. Avoid over-explaining. Regulators and analysts value clarity over creativity.

Use:

- Numbers where required

- Direct responses where asked

- Consistent units and formats

Remember, this document lives inside your annual report. Any contradiction will be noticed.

Step 5: Internal Review, Validation, and Sign-Off

Before submission, conduct a cross-functional review involving:

- Sustainability / ESG team

- Legal & Compliance

- Finance

- Internal audit (if available)

Many mature companies now conduct internal BRSR assurance dry-runs even before external assurance becomes mandatory.

This step is what separates a rushed filing from a credible one.

Step 6: Submit Along With Annual Report

BRSR is filed as part of your annual report submitted to stock exchanges. Ensure:

- Correct version control

- Board approval where applicable

- Alignment with Director’s Report and CSR disclosures

Once submitted, treat BRSR as a living framework, not a one-time task.

How BRSR 2.0 Changes the Filing Mindset?

If you’re preparing for upcoming cycles, here’s the shift you must internalize.

BRSR 2.0 is about comparability and credibility.

That means:

- More standardized metrics

- Higher expectation of year-on-year consistency

- Increased likelihood of assurance

- Greater investor interrogation

Companies that treat BRSR filing as a compliance checkbox will struggle. Those that integrate it into ESG governance will gain trust—and capital.

Common Mistakes

Let’s be blunt. These are mistakes we see repeatedly:

- Treating BRSR as a copy-paste exercise

- Collecting data without ownership clarity

- Overstating ESG performance without evidence

- Ignoring value-chain disclosures

- Filing without internal validation

Any one of these can undermine credibility.

Final Thoughts

Filing BRSR Is Not About Reporting—It’s About Readiness. So, how to file BRSR report effectively?

You don’t start with the format.

You start with systems, ownership, and governance.

BRSR filing is fast becoming a proxy for how seriously a company takes ESG. Done right, it strengthens investor confidence. Done poorly, it raises more questions than answers.

ACT NOW – FREE BRSR FILING ASSESSMENT

Ready to Get Your BRSR Filing Right — Without Guesswork?

No sales pressure. No commitments. Just clear, expert guidance you can act on immediately.

If you’re struggling with data gaps, unclear ownership, or BRSR 2.0 alignment, don’t wait until the reporting deadline hits. We offer a free, no-obligation BRSR consultation to help you assess readiness, identify gaps, and create a clean filing roadmap.