If you searched for “ESG reporting framework India”, your intent is usually one of these: you want to understand what ESG reporting actually means in the Indian context, which frameworks companies use, what regulators and investors expect, and how to implement reporting without turning it into a “tick-box” exercise. This guide is written to take you from first principles to advanced, practical execution—without assuming prior ESG expertise.

What ESG Reporting Means in India?

ESG reporting is how an organisation communicates its Environmental, Social, and Governance performance to stakeholders—investors, lenders, customers, regulators, employees, and the public. In India, ESG reporting has moved from “nice to have” to “strategic necessity,” particularly for listed companies and firms in global supply chains.

An ESG reporting framework India approach is not one single document or standard. It is typically a combination of:

- Indian regulatory disclosures (where applicable), and

- global reporting standards used to meet investor and international customer expectations.

The goal is straightforward: disclose ESG risks, impacts, policies, metrics, and outcomes in a way that is consistent, comparable, and decision-useful.

Why ESG Reporting is Now a Board-Level Agenda?

Companies adopt an ESG reporting framework India for four practical reasons:

- Investor and lender scrutiny: ESG risk is increasingly linked to cost of capital and long-term valuation.

- Customer/supply chain requirements: Global buyers often require ESG disclosures or audits.

- Risk management: Climate, water, safety, labour practices, and ethics issues can become material risks quickly.

- Regulatory direction of travel: India is steadily strengthening structured sustainability disclosures for large enterprises.

In short: ESG reporting is no longer just reputation management — it is a governance and performance discipline.

Core Components of an ESG Reporting Framework India

No matter which standards you follow, most ESG reports are built on the same backbone:

1) Materiality (What Actually Matters)

“Material” topics are those that can influence decisions of stakeholders (especially investors) or have significant impact through your operations and value chain.

Materiality typically covers:

- Environment: energy, emissions, water, waste, biodiversity

- Social: health and safety, labour practices, diversity, community impact, customer responsibility

- Governance: ethics, compliance, board oversight, cybersecurity, anti-corruption, whistleblower systems

2) Metrics and Targets (Quantification Over Narratives)

Strong ESG reporting is numbers-first:

- Baseline metrics (current performance)

- Targets (where you want to go)

- Progress (trend and performance vs target)

3) Governance and Accountability

Stakeholders want to know:

- Who owns ESG outcomes (board committee, CXO sponsor)?

- How ESG is integrated into strategy and risk?

- Whether incentives (KPIs/variable pay) include ESG outcomes

4) Controls, Evidence, and Assurance Readiness

High-quality ESG reporting framework India implementations build evidence trails:

- Defined calculation methodologies

- Clear data ownership

- Audit-ready documentation and internal controls

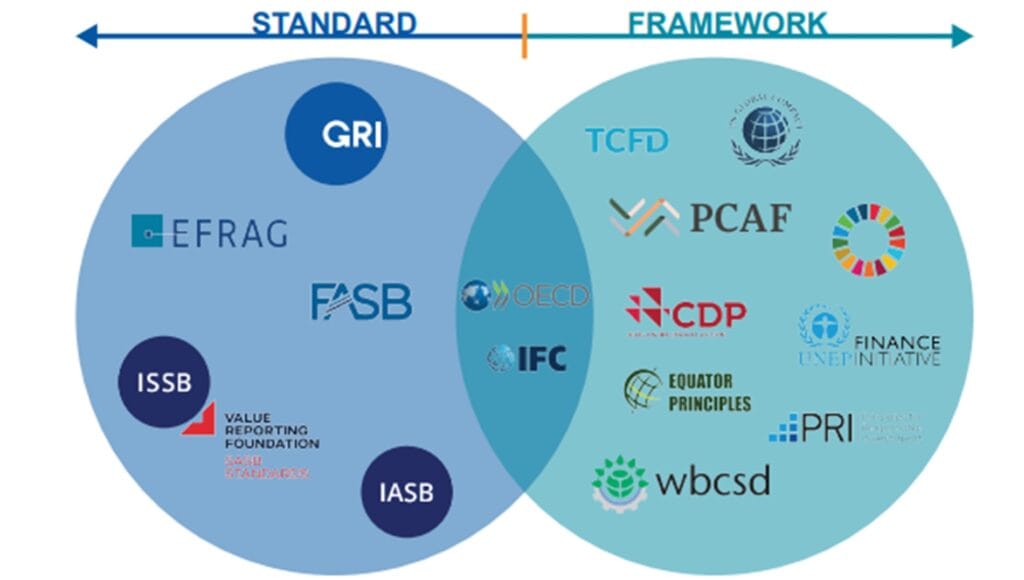

The Key ESG Reporting Standards and How They Show Up in India?

India-based companies often face a mixed landscape of expectations. Here are the most common frameworks used in practice:

BRSR (Business Responsibility and Sustainability Reporting)

For many Indian listed companies, BRSR is the central, India-specific disclosure structure. Even where not mandatory, it is increasingly used as a benchmark because it is designed for Indian regulatory and stakeholder needs.

Global Frameworks Frequently Used Alongside Indian Disclosures

GRI (Global Reporting Initiative)

GRI is widely used for broad sustainability disclosures and stakeholder-focused reporting. It’s strong for impacts across environment and society, including labour and community.

SASB (Sustainability Accounting Standards Board)

SASB is industry-specific and investor-oriented. It helps organisations report financially material sustainability topics by sector (e.g., banking vs manufacturing metrics differ).

TCFD (Task Force on Climate-related Financial Disclosures)

TCFD focuses on climate risk governance, strategy, risk management, and metrics/targets—especially scenario analysis and climate-related financial impacts.

IFRS Sustainability (ISSB: S1 and S2)

ISSB standards are designed for consistent sustainability disclosure for capital markets. In practice, many firms align climate disclosures to S2 and broader sustainability to S1 to meet global investor expectations.

In real-world ESG reporting framework India programs, organisations commonly map:

- India disclosures (like BRSR format requirements where applicable), and

- global investor-aligned disclosure (GRI/SASB/TCFD/ISSB-style outputs)

into one coherent reporting system.

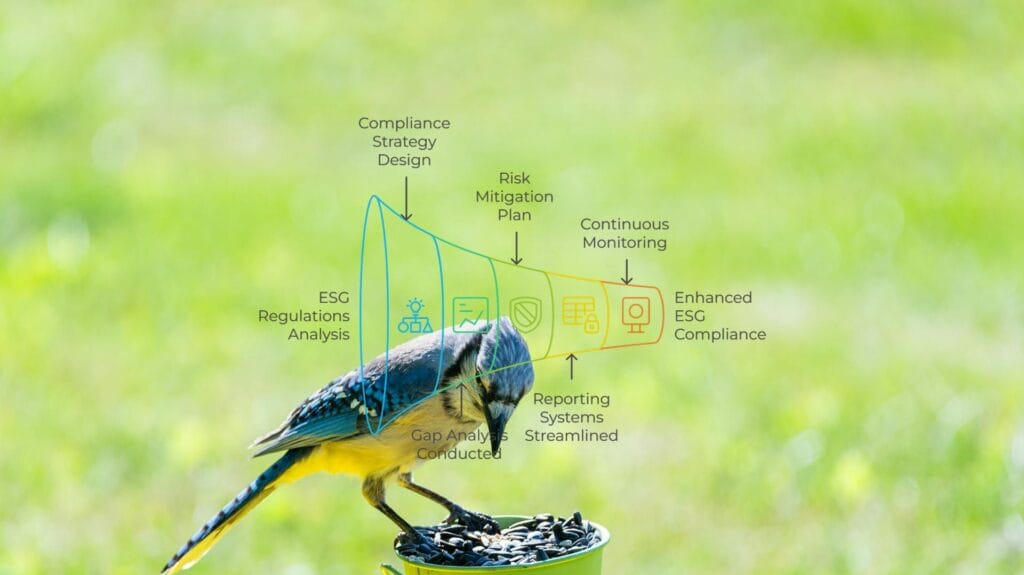

Beginner Level: How to Start ESG Reporting the Right Way?

If you are starting from scratch, don’t begin with designing a glossy report. Begin with building a system.

Step 1: Define Scope and Boundaries

Decide:

- Which entities are covered (parent company, subsidiaries)?

- Which operations and geographies?

- What period?

- What parts of the value chain matter (upstream suppliers, downstream use of products)?

Step 2: Build a Materiality Register

Run a structured materiality exercise:

- Stakeholder interviews (investors, lenders, customers, employees)

- Risk register alignment

- Peer benchmarking

- Regulatory and sector scan

Output: a ranked list of ESG topics and why they matter.

Step 3: Identify Metrics and Data Owners

Create an ESG KPI register:

- Metric definition

- Calculation method

- Data source system (ERP, EHS logs, HRIS)

- Frequency (monthly/quarterly)

- Owner (department + responsible person)

Step 4: Establish Governance

Minimum governance setup:

- Board/committee oversight (or formal sponsor)

- ESG steering group

- Policy ownership (code of conduct, H&S policy, supplier code)

- Escalation and issue management process

Step 5: Pilot Data Collection

Choose 10–20 core metrics and run a “dry collection” exercise:

- Can you collect it reliably?

- Is the data complete?

- Are assumptions consistent?

This pilot phase is where most ESG reporting framework India projects either become stable—or collapse under data chaos.

Intermediate Level: Making ESG Reporting Decision-Useful

Once basics are in place, reporting must progress from compliance to insight.

1) Link ESG to Business Strategy

Examples:

- Manufacturing: energy efficiency and yield improvements reduce costs and emissions

- Logistics: route optimisation reduces fuel spend and emissions

- HR: retention programs reduce hiring costs and improve productivity

- Procurement: supplier ESG screening reduces disruption risk

Your ESG report should clearly show how ESG priorities support business goals.

2) Integrate ESG Into Risk and Internal Controls

Treat ESG data like financial data:

- Defined controls (review, approval, exception tracking)

- Version control

- Documentation of methodologies

- Management sign-off

This is how you become assurance-ready.

3) Improve Comparability With Consistent Methodologies

The biggest credibility killers in ESG reporting are:

- changing definitions year-to-year

- not disclosing boundaries

- inconsistent emission calculation approaches

- selective metrics (“we report what looks good”)

A mature ESG reporting framework India program standardizes definitions and discloses limitations transparently.

Advanced Level: Climate, Value Chain, and Assurance-Ready Reporting

1) Scope 1, 2, and 3 Emissions Maturity

- Scope 1: direct emissions (on-site fuel, owned vehicles)

- Scope 2: purchased electricity (and sometimes steam/heat)

- Scope 3: value chain emissions (purchased goods, logistics, business travel, use of sold products, etc.)

Advanced reporting increasingly requires Scope 3 estimation and supplier engagement. The best approach is staged:

- Start with the largest Scope 3 categories relevant to your business model

- Improve quality over time (from spend-based estimates to activity-based data)

2) Scenario Analysis and Climate Risk Integration

Climate-focused disclosures often require scenario thinking:

- physical risks (heat stress, floods, water scarcity)

- transition risks (carbon pricing, market shifts, regulation)

- resilience actions (capex planning, supplier diversification)

Advanced ESG reporting framework India efforts incorporate climate risk into enterprise risk management and capex plans.

3) Value Chain Due Diligence

For export-linked businesses, customers increasingly ask:

- supplier labour practices

- conflict minerals, forced labour indicators

- health and safety maturity

- environmental compliance and incident history

A mature ESG program builds supplier codes, onboarding checks, audits, and remediation support.

4) External Assurance Readiness

If you want credibility with investors, assurance matters. Preparation includes:

- evidence files for each KPI

- reconciliations to source systems

- documented calculation methods

- internal audit checks (or independent reviews)

Practical Implementation: A Workable ESG Reporting Operating Model

A pragmatic ESG reporting framework India operating model typically includes:

People

- Board sponsor / ESG committee oversight

- ESG program manager

- Metric owners across EHS, HR, finance, procurement, compliance

- Internal audit or controls function participation

Process

- Annual materiality refresh

- Quarterly KPI reporting cycle

- Incident tracking (safety, compliance, whistleblower)

- Supplier ESG due diligence workflow

Technology

- Start with structured spreadsheets + data governance

- Move to ESG data platforms when scale demands it

- Integrate with ERP/EHS/HR systems to reduce manual handling

Documentation

- Policies (ethics, H&S, supplier code, privacy/cyber, anti-corruption)

- SOPs for data collection and calculations

- Evidence and approvals

Expert Insights: What Separates Strong ESG Reports From Weak Ones?

1) Specificity Beats Storytelling

Weak ESG reporting is generic (“we care about the planet”). Strong reporting:

- discloses baselines, trends, and targets

- explains why topics are material

- demonstrates measurable progress

2) Don’t Overclaim

If your program is early-stage, say so. Credibility grows when reporting is honest about gaps and roadmap.

3) Connect ESG Outcomes to Financial and Operational Outcomes

Examples:

- energy reduction linked to cost savings

- safety improvements linked to reduced downtime

- governance improvements linked to reduced compliance incidents

4) Build for Consistency Over Perfection

The best ESG reporting framework India programs prioritise:

- consistent definitions

- repeatable data cycles

- incremental improvement

That is how you scale ESG reporting year after year.

Common Mistakes to Avoid in ESG Reporting

- Starting with design instead of data systems

- No clear ownership for metrics

- Reporting only “good news”

- Ignoring Scope 3 and supplier risks until it becomes a customer issue

- Not aligning ESG priorities to business strategy

- No audit trail (making assurance impossible)

Conclusion

An effective ESG reporting framework India approach is not just about producing a report — it is about building a reliable governance and performance system that can stand up to investor scrutiny, customer expectations, and evolving regulation. Start with materiality, define metrics and owners, establish controls, and then progress toward advanced climate and value chain disclosures. Companies that treat ESG reporting as a disciplined operating model — not a marketing activity — will produce credible disclosures and gain a strategic advantage in capital, customers, and risk resilience.