ESG compliance means proving that your business is responsible, fair, ethical, and sustainable—not just in words, but with actions, policies, and measurable results.

Companies that meet ESG standards are seen as lower risk and more trustworthy by investors, regulators, customers, and the public. In India, it’s especially becoming important due to SEBI’s regulations like BRSR (Business Responsibility and Sustainability Report), which require formal reporting from top companies.

Environmental, Social, and Governance (ESG) compliance is no longer optional—it’s a strategic imperative. With India aligning closely with global ESG regulatory frameworks and investor expectations growing sharper, companies of all sizes must now demonstrate real, verifiable ESG commitment.

—

When I first sat across the table from a mid-sized Indian textile exporter struggling with SEBI’s new BRSR mandate, one thing was crystal clear: ESG compliance wasn’t just a checkbox—it was a turning point.

With SEBI mandating ESG disclosures for India’s top 1,000 listed companies and the global wave of sustainability regulations rising, compliance has become survival.

This guide breaks down exactly how Indian businesses can achieve seamless ESG compliance—without drowning in jargon or red tape.

—

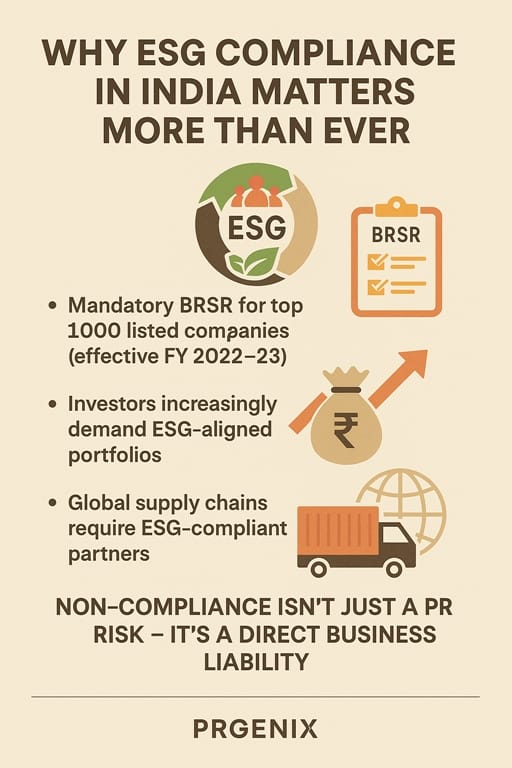

Why ESG Compliance in India Matters More Than Ever?

ESG (Environmental, Social, and Governance) is no longer a Western corporate trend. In India, regulators are pushing for transparency and sustainability like never before. Here’s what’s changed:

- Mandatory BRSR (Business Responsibility and Sustainability Reporting) for top 1,000 listed companies (effective FY 2022–23)

- Investors increasingly demand ESG-aligned portfolios

- Global supply chains require ESG-compliant partners

Non-compliance isn’t just a PR risk – it’s a direct business liability.

—

ESG Compliance Framework in India – BRSR Breakdown

The BRSR framework is India’s ESG backbone. It replaces the Business Responsibility Report (BRR) and aligns with global standards such as GRI and TCFD.

Key BRSR Elements:

- Leadership & Governance: Board-level responsibility on ESG

- Policies & Practices: Environmental policies, CSR, ethics

- KPIs & Metrics: Energy use, water usage, emissions, employee wellbeing

- Stakeholder Engagement: Disclosures to investors, regulators, public

—

Step-by-Step ESG Compliance Roadmap for Indian Companies

Here’s how your organization can build a seamless ESG compliance strategy:

Step 1: Conduct a Baseline ESG Assessment

- Gap analysis vs. BRSR framework

- Materiality assessment

- Stakeholder mapping

Step 2: Define ESG Goals & Governance

- Set KPIs aligned to BRSR

- Create cross-functional ESG teams

- Design board oversight processes

Step 3: Implement Tracking & Reporting Mechanisms

- Automate data capture

- Use ESG management platforms (India-specific like SustLabs, Global like Envizi)

- Align with GRI, SASB, and BRSR standards

Step 4: Audit, Certify & Disclose

- Internal audit with third-party validation

- Submit annual BRSR disclosures via SEBI format

- Prepare for investor Q&A and stakeholder scrutiny

—

India vs Global ESG Mandates – A Comparison Table

| Feature | India (SEBI BRSR) | EU (CSRD) | USA (SEC Climate Rule) |

|---|---|---|---|

| Mandate | Mandatory for top 1,000 listed firms | Mandatory for large listed & private firms | Applies to listed companies with climate risk |

| Framework | BRSR (GRI-aligned) | ESRS (aligned to GRI, TCFD) | SEC’s Proposed Climate Disclosures |

| Focus | ESG impact, policies, KPIs | Double materiality + stakeholder reporting | Climate risk + financial impact |

| Assurance Requirement | Not yet mandatory | Phased-in assurance from 2026 | Limited assurance expected |

| Penalties for Non-Compliance | Stock exchange observations | Legal liability, fines | SEC enforcement, shareholder lawsuits |

| Timeline | 2022–23 onward | Full adoption by 2026 | Rollout expected 2025 onwards |

—

Common Pitfalls to Avoid in ESG Compliance (Indian Context)

- Treating ESG as CSR – ESG is performance-based; CSR is spend-based.

- Copy-paste Reporting – Every sector has different material risks.

- No Board Involvement – SEBI requires governance-level ownership.

- Ignoring Supply Chain – Scope 3 emissions matter.

- Using Global Tools Blindly – Customize tools to Indian regulatory frameworks.

—

How Prgenix Helps You Ensure Seamless ESG Compliance?

At Prgenix, we’ve built a proven system tailored for Indian businesses navigating ESG compliance.

Our Services:

- ESG Gap Assessments aligned to SEBI/GRI/TCFD

- BRSR Report Creation and Filing Support

- Carbon Accounting & Emission Mapping

- ESG Software Recommendations & Implementation

- Internal Training for Compliance Teams

- Ongoing Compliance Audit & Investor-Ready Dossiers

A mid-sized FMCG firm in Gujarat cut its emissions reporting lag by 73% within 3 months using our ESG audit framework and transitioned from BRR to BRSR with zero SEBI objections.

Ready-to-Use ESG Compliance Tools (Free)

- ESG Materiality Assessment Checklist

- BRSR Readiness Questionnaire

- Sample ESG Governance Framework Template

FAQs: ESG Compliance in India

1: Is BRSR mandatory for all Indian companies?

As of FY 2022–23, it’s mandatory only for the top 1,000 listed firms. Others are encouraged to voluntarily comply.

2: Is ESG only about environmental issues?

No. Governance (transparency, ethics) and social factors (labour, equity) are just as critical.

3: How can a small business start ESG compliance?

Begin with a self-assessment, basic policy drafts, and small environmental footprints—compliance scales over time.

4: Can ESG compliance improve investor relations?

Absolutely. ESG performance can lower capital costs, attract sustainability funds, and strengthen IPO valuation.

5: How long does full compliance take?

For most mid-sized firms, the transition to full ESG readiness can take 3–6 months with structured support.

STAY COMPLIANT STAY COMPETITIVE