My ESG Reality Check Moment (And Why It Reshaped Everything)

I still remember walking into a boardroom in mid-2022, helping an Indian electronics firm prep for a global sustainability audit. The founder, confident and well-meaning, waved a two-page PowerPoint at me and said:

“This is our ESG checklist. We’re good to go, right?”

Unfortunately, no.

The client missed key disclosures on governance, had zero data on supply chain ethics, and didn’t realize SEBI’s BRSR guidelines had just become mandatory for top 1,000 listed firms.

They thought ESG was just a corporate buzzword.

But in reality, it’s become a compliance imperative, reputation driver, and investment gateway all rolled into one.

And they’re not alone. A 2024 report by Ernst & Young revealed that 58% of Indian companies fail at basic ESG readiness, often because they lack a structured, verified checklist to follow.

That’s why I’ve created this comprehensive, battle-tested ESG compliance checklist—for Indian businesses who want to get it right.

Why You Need a Solid ESG Compliance Checklist?

✅ 1. Investors Now Demand ESG Proof

No one’s throwing money at gut feelings anymore.

Today’s VCs, PE firms, and even banks demand ESG-linked metrics and documentation—ideally certified or assured.

Having a complete checklist helps:

- Prepare investor decks with verifiable ESG metrics

- Shorten due diligence cycles

- Increase funding eligibility

✅ 2. You’ll Stay Ahead of Indian Regulations

With SEBI mandating BRSR (Business Responsibility & Sustainability Report) for the top 1,000 listed companies, even MSMEs are now feeling indirect pressure from clients and supply chain partners.

This checklist will help you stay:

- Ready for BRSR Core mapping

- Aligned with GRI or SASB frameworks

- Prepared for future ESG audits

✅ 3. It Builds Brand Equity + Operational Resilience

Today’s consumers and partners value ethics, climate action, and transparency.

An ESG checklist helps you:

- Spot gaps in your governance

- Improve environmental KPIs

- Document compliance before problems arise

The Step-by-Step ESG Compliance Checklist (Built for Indian Businesses)

This isn’t a generic checklist. It’s the same framework we’ve used at Prgenix for 50+ ESG compliance projects across India’s tech, pharma, and manufacturing sectors.

🧭 A. Governance & Ethics Checklist

- [ ] Board has ESG as a standing agenda item

- [ ] Defined ESG policy approved by leadership

- [ ] Whistleblower protection mechanism exists

- [ ] Transparent anti-bribery & anti-corruption policies

- [ ] DEI (Diversity, Equity, Inclusion) metrics tracked and disclosed

- [ ] ESG KPIs linked to executive compensation

- [ ] Independent directors trained in ESG topics

🌍 B. Environmental Metrics Checklist

- [ ] Carbon emissions (Scope 1, 2—and 3 if applicable) tracked quarterly

- [ ] Energy consumption (renewables vs fossil fuels) measured

- [ ] Water usage, recycling, and discharge data documented

- [ ] Waste management (hazardous and non-hazardous) in place

- [ ] Biodiversity impact monitored (especially for infrastructure firms)

- [ ] Supplier environmental practices assessed

- [ ] Compliance with environmental laws (e.g., EPR, CPCB norms)

🤝 C. Social Responsibility Checklist

- [ ] Occupational health & safety policies documented

- [ ] Gender ratio, pay equity, and workplace culture metrics disclosed

- [ ] Employee training hours on ESG topics tracked

- [ ] Vendor/supplier code of conduct in place

- [ ] Community engagement programs reported

- [ ] Social grievance redressal system operational

- [ ] ESG risks in value chain identified and managed

🧾 D. ESG Reporting & Assurance Checklist

- [ ] Materiality assessment done in the last 12 months

- [ ] ESG report published annually (GRI/SASB/BRSR format)

- [ ] ESG KPIs externally assured by a licensed body (TUV, DNV, etc.)

- [ ] ESG disclosures mapped to SDGs (optional but impactful)

- [ ] Website has ESG section with latest disclosures

- [ ] ESG ratings tracked (Sustainalytics, MSCI, etc.)

Pro Tips for Making the Checklist Actionable

🧠 1. Assign Ownership

For each checklist item, assign a functional owner:

- CFO for governance

- CHRO for social KPIs

- COO for environmental data

This avoids siloed reporting and last-minute fire drills.

💻 2. Use Automation

We use simple tools like:

- Google Data Studio for ESG dashboards

- Trello for checklist tracking

- Excel macros for automated KPI trend analysis

🧩 3. Bundle with ISO Audits

Combine ESG with:

- ISO 14001 (Environment)

- ISO 45001 (Health & Safety)

- ISO 26000 (Social Responsibility)

It saves audit time and creates multi-standard resilience.

Case Study: ₹6 Cr Export Order Saved with ESG Checklist

In 2023, a Pune-based manufacturing SME came to us in panic. Their EU buyer demanded ESG compliance within 45 days.

What we did:

- Ran checklist audit using our framework

- Prioritized gaps using a 3-tier severity matrix

- Created a GRI-aligned ESG disclosure doc

- Brought in TUV for basic assurance

📈 Outcome:

- Order worth ₹6 Cr secured

- Featured on EU supplier watchlist for ESG alignment

- Onboarded as preferred vendor for two new buyers

FAQs: People Also Ask

1. What is an ESG compliance checklist?

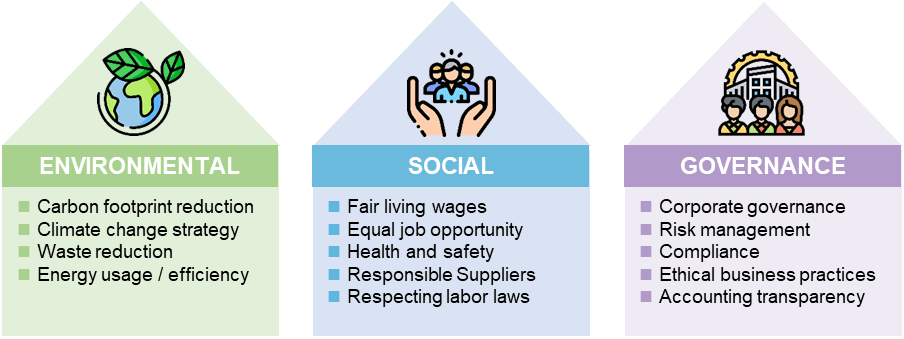

It’s a structured list of governance, environmental, and social action items that ensure a business meets both legal and ethical ESG benchmarks.

2. Who needs an ESG checklist?

Any company seeking funding, regulatory clearance, export certification, or supply chain partnerships should use one.

3. Is there a standard ESG checklist in India?

SEBI’s BRSR is the closest to a formal checklist. GRI and ISO also provide frameworks. This blog’s checklist combines all major standards.

4. What happens if I skip ESG compliance?

You risk losing contracts, failing audits, investor red flags, or even regulatory penalties in sectors like pharma, infra, and textiles.

5. How long does ESG compliance take?

Depends on company size and maturity. For MSMEs, a basic checklist can be completed in 4–6 weeks with proper guidance.

✅ Your Next Step: Use This Checklist to Get Compliant

This isn’t just a to-do list. It’s a risk-reducer, revenue-driver, and trust-builder.

At Prgenix, we help Indian businesses:

- Audit their ESG readiness

- Create GRI/BRSR-aligned reports

- Get certified via TUV or DNV

- Automate their compliance dashboard

🎯 Let us help you check every box before your next investor or client meeting.