Get Fund-Ready, Stay Compliant, and Unlock Growth with Our Startup Funding Services

Beyond Compliance, We Position You for Funding Success.

Raising capital is no longer just about vision — it’s about validation. Prgenix transforms your compliance and governance frameworks into investor-ready assets that accelerate funding and establish lasting credibility.

Build Trust. Attract Capital. Scale Responsibly.

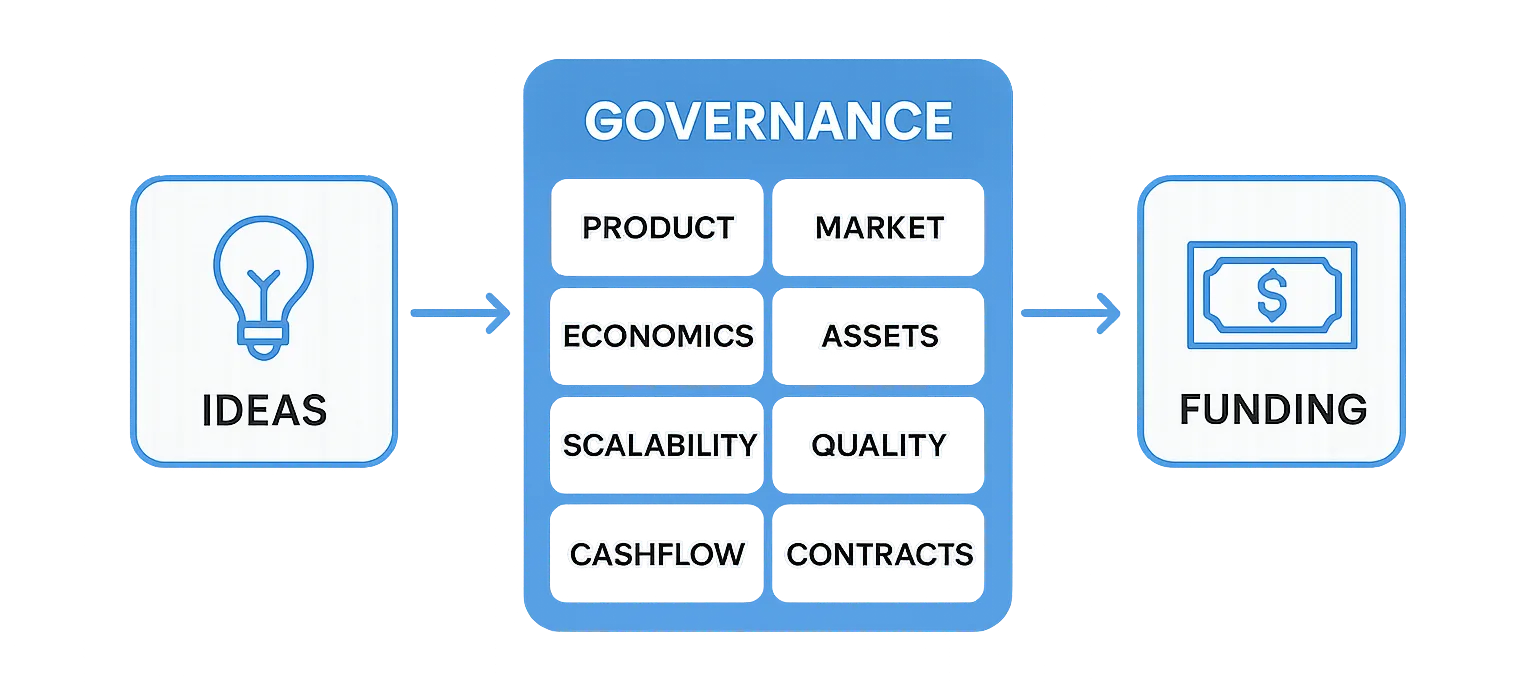

Investors Don’t Fund Ideas, They Fund Governance

When you approach investors today, you’re not simply asking for funds to build something new. You’re asking for confidence: that your business has been built on a foundation of structure, transparency and enshrined value. That’s where we at Prgenix come in — governance disciplines in place, data protection assured, compliance mapped out — so investors see you’re ready, not just enthusiastic.

At the end of the day, what investors are really funding is the risk-managed engine behind your product: the asset structure, the correct contracts, the audited books, the scalable model, the exit strategy. If you can show governance built in from Day 1 – product, market, economics, scalability, defense, quality, books, cashflow, audit, contracts – you’re not chasing funds, you’re sealing confidence.

In short: clean governance is your entry ticket. Good ideas open doors—but robust governance keeps investors moving forward with you.

Everything You Need to Inspire Investor Confidence

Raising funds isn’t just about having a great idea — it’s about proving you’re investment-ready. At Prgenix, we help you build the trust investors demand by aligning your business with the same governance, compliance, and transparency standards used by global funding institutions. From ESG and BRSR frameworks to investor-grade documentation and due diligence validation, every component is designed to make your startup a safe and credible bet for investors.

| Service Suite | What It Covers | Key Outcomes |

|---|---|---|

| 1. Fund Readiness Compliance Pack | ESG, BRSR, DPDP, ISO, statutory governance & disclosure compliance | Complete due diligence readiness |

| 2. Investor-Grade Documentation | Pitch deck validation, PPM & CIM, ESG narratives, data governance statements | Professional investor-grade presentations |

| 3. Grant & Subsidy Assistance | Startup India, MSME, CSR, DPIIT, NIDHI, and international schemes | Access to non-dilutive and soft capital |

| 4. Angel / HNI / VC / PE Support | Deal hygiene, investor KYC, MIS setup, ESG-linked pitch packs | Higher valuation and smoother negotiations |

| 5. International Funding Gateway | ESG, EPR, and compliance packs aligned with EU/US frameworks | Entry into global fund and supply-chain networks |

| 6. Post-Funding Governance & Audits | Risk reviews, ESG reporting, board evaluation, sustainability disclosures | Strong governance and continued investor trust |

| 7. ESG-Linked Finance Advisory | ESG scoring, impact valuation, performance metrics | Eligibility for ESG & impact-linked finance |

Whether you’re preparing for seed, venture, or institutional rounds, our end-to-end Funding Readiness Suite ensures you meet every benchmark — from compliant disclosures and validated financial narratives to risk governance and ESG-linked performance metrics. This gives investors the clarity and confidence they need to back your growth, while unlocking access to non-dilutive grants, international networks, and impact-linked finance opportunities.

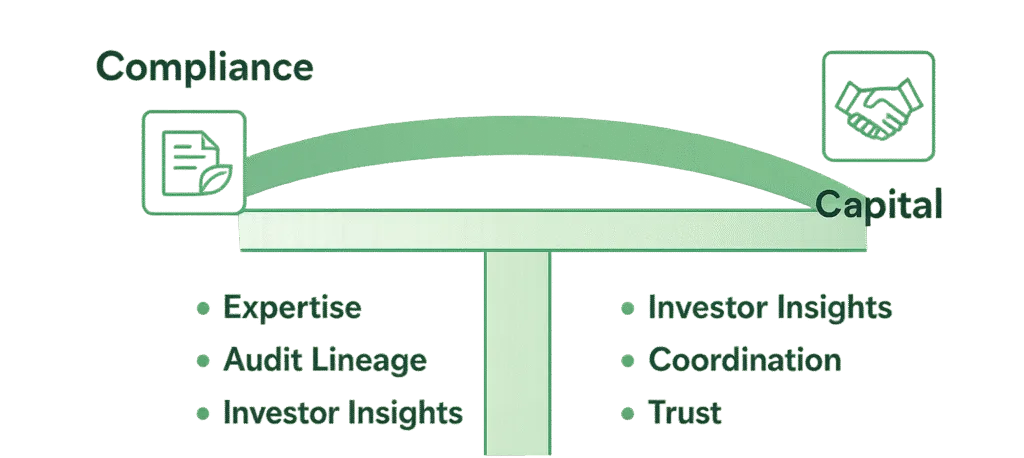

Why Prgenix?

At Prgenix, we don’t just certify compliance — we translate it into investor confidence. Our startup funding service framework bridges the gap between governance excellence and funding momentum, helping founders present audit-backed, investor-trusted data that accelerates funding approvals. Beyond Compliance. We Position You for Funding Success. We go beyond checklists — we align your compliance posture with your funding ambitions.

✅ Cross-functional expertise: Legal, Financial, ESG, and Regulatory

✅ Recognized audit lineage: ISO, NABL, DPDP, CSRD, BRSR

✅ Investor-readiness insights: from startup to Series-C stage

✅ End-to-end coordination: documentation → audit → board approval

✅ Trusted by investors, incubators, and corporates across industries

Remember: Compliance builds credibility. Credibility builds capital.

Who We Work With?

If You’re Serious About Funding — You’re Our Client.

- For Startups: Preparing for Seed, Angel, or Series-A rounds needing governance-backed investor decks.

- For Growth-Stage Firms: Planning for PE, VC, or strategic investment with institutional investors.

- For Enterprises: Seeking ESG-linked finance, international funding, or global supply-chain entry.

Outcome: Wherever you are in your funding journey, Prgenix’s startup funding service ensures your documentation, compliance, and governance story stand up to investor scrutiny.

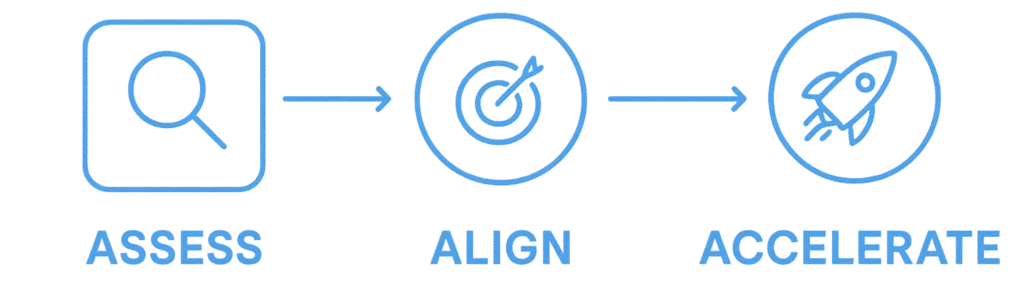

How It Works?

- Diagnose: Deep-dive assessment of governance, compliance gaps, and investor expectations.

- Design: Build a tailored compliance and documentation suite aligned to funding requirements.

- Deliver: Prepare investor-ready reports, ESG disclosures, and audit certificates that unlock confidence.

Our Edge

The Prgenix Advantage

- Compliance + Capital Synergy: Dual focus on investor needs and regulatory frameworks.

- Outcome-Oriented Delivery: Measurable impact — reduced funding time, stronger valuations.

- Global Standards: Frameworks aligned with GRI, SASB, CSRD, and IFC ESG norms.

- Technology Backbone: AI-driven compliance automation and investor reporting tools.

READY TO RAISE WITH CONFIDENCE?

Let’s Get You Fund-Ready

The next funding round should validate your growth — not question your governance. Partner with Prgenix to make your compliance your strongest funding advantage.

We’ll assess your current readiness, identify red flags, and design your investor-grade compliance roadmap.

Startup Funding Service – FAQs

1. What is Prgenix’s Startup Funding Service designed to achieve?

Our service is built to convert startups into investor-ready entities by strengthening governance, compliance, documentation quality, and strategic readiness. We ensure you present a credible, defensible, and investment-worthy proposition that matches the expectations of angels, VCs, institutional investors, and strategic partners.

2. How is this different from traditional fundraising consultants?

Typical fundraising consultants focus primarily on pitch decks and networking. Prgenix operates differently — we strengthen the foundation behind the pitch: governance, compliance, financial controls, scalability evidence, ESG positioning, contracts, policies, and risk controls. Investors fund governance, not ideas. We prepare you to withstand real due-diligence, not just a meeting.

3. What stages of startups do you support?

We assist companies across the spectrum:

– Early-Stage: idea to MVP seeking angel / pre-seed / seed funds.

– Growth-Stage: seeking VC, large seed, Series A–C, or strategic capital.

– Enterprise-Scale: mature companies preparing for institutional rounds, global expansion, or compliance-heavy investor requirements.

4. Do you help with investor introductions?

Yes — but only after your governance, compliance, and documentation meet investor-grade standards. We prioritize making you truly fund-ready first. Investor connections are leveraged once the fundamentals meet thresholds that prevent reputational or credibility risk.

5. What documents and deliverables do you provide?

Depending on the package, deliverables include:

– Investor-grade documentation suite

– Governance & compliance assessment reports

– Pitch deck, financial model, and investment thesis

– Policies, SOPs, contracts, statutory compliance

– ESG, DPDP, BRSR, ISO, ABDM/NHA-aligned documents (as applicable)

– Risk registers, scalability roadmap, and operational frameworks

– Due-diligence-ready proof points, data rooms, and checklists

6. How long does it take to become fund-ready?

Timelines vary based on your current maturity:

– Early-stage startups: 4–8 weeks

– Growth/VC-stage companies: 6–12 weeks

– Enterprise-level readiness: 12–20 weeks

We work on accelerated timelines where required, without compromising governance quality.

7. What if we already have a pitch deck or compliance documentation?

We audit what you currently have, identify gaps relative to investor expectations, and redesign or enhance everything where needed. Even strong startups often miss investor-critical compliance elements — we close those gaps precisely.

8. Do you assist in building financial models?

Absolutely. Our experts build investor-grade financial models, scenario plans, CAC/LTV analytics, revenue forecasts, and unit economics validated against market expectations and sector benchmarks.

9. Will you support us during due-diligence with investors?

Yes. We provide end-to-end DD support — documentation, clarifications, risk mitigation notes, compliance evidence, and investor query management. Our goal is to eliminate surprises and protect your credibility in front of investors.

10. Are your services industry-agnostic?

Yes. Prgenix serves startups across technology, health-tech, manufacturing, SaaS, fintech, D2C, green tech, consulting, and more — with specialized strengths in ESG, Data Protection (DPDP), healthcare compliance (NHA/ABDM), and certification-driven businesses.

11. What makes your governance-led approach critical for fundraising?

Investors predominantly evaluate:

– Governance discipline

– Compliance hygiene

– Scalability and risk exposure

– Financial reliability

– Contractual and legal readiness

We position your startup to meet these parameters so your story is not just compelling — it is credible and defensible.

12. Can Prgenix help with regulatory or certification requirements tied to funding?

Yes. Many investors require or prefer certifications like ISO, DPDP compliance, BRSR/ESG maturity, ABDM compliance, and more. Prgenix is certified and equipped to deliver these frameworks end-to-end.

13. Are your solutions customizable?

100%. No two startups have identical governance, compliance, or operational structures. Every engagement is tailored to your stage, industry, funding target, and investor type.

14. What is the cost structure?

Pricing depends on:

– Startup stage

– Scope of governance, compliance, and documentation requirements

– Desired funding size

– Urgency and complexity

We offer tiered packages with transparent deliverable lists and measurable outcomes.

15. How do we start?

Simple — book a Free Funding Readiness Consultation. We evaluate your governance, compliance, documentation, and investor-readiness level, then propose a clear roadmap to accelerate your funding journey.